Fellow of CSI (FCSI®)

What is Fellow of CSI (FCSI®)?

The Fellow of CSI (FCSI®) is the pinnacle financial services credential and the highest honour in Canadian financial services. It is reserved for an exclusive group of financial professionals who demonstrate unparalleled leadership, integrity, commitment, and dedication to their clients and industry.

By earning this pinnacle credential, you have entered an exclusive community of financial services professionals in Canada. The FCSI® not only places you among the industry's finest—it makes you one of the most sought-after professionals by clients and employers alike.

When you earn the FCSI®, you become a member of an exclusive group of financial professionals recognized and respected by clients, employers, colleagues, and the investing public. As an FCSI your commitment to education and willingness to be a distinguished leader, industry ambassador, and mentor, is unprecedented.

What is the path to the Fellow of CSI (FCSI®)?

To earn your FCSI®, you must meet the following education requirements:

1. Hold one of the following designations:

- Personal Financial Planner (PFP®)

- Certified International Wealth Manager (CIWM)

- Chartered Investment Manager (CIM®)

- MTI® Estate and Trust Professional (MTI®)

- Institut québécois de planification financière (IQPF)

- Certified Financial Planner (CFP®)

- Chartered Financial Analyst (CFA®)

- Chartered Life Underwriter (CLU®)

- Registered Financial Planner (RFP)

External Designation Recognitions are subject to CSI’s External Designation Recognition policy and fee.

2. Complete the Financial Services Industry: Business Drivers and Challenges (FSDC) course:

The Financial Services Industry: Business Drivers and Challenges (FSDC) course is a requirement for designation holders who are qualifying for the respected Fellow of CSI (FCSI®) credential.

3. Complete two courses from the following list of eligible courses:

These courses must be from a different stream than that leading to the Designation(s) you already hold.

- Estate and Trust Administration (ETA)

- Financial Planning II (FPII)

- Wealth Management Essentials (WME®)

- Investment Management Techniques (IMT®)

- Portfolio Management Techniques (PMT®)

- Advanced Derivatives Market Strategies (ADMS)

- Advanced Investment Strategies (AIS)

- Derivatives Fundamentals Course (DFC®)

- Technical Analysis Course (TAC)

- Options Supervisors Course (OPSC)

- Chief Compliance Officers Qualifying Examination (CCO)

- Branch Compliance Officer’s Course (BCO)

- Partners, Directors and Senior Officers Course (PDO)

- Trader Training Course (TTC)

- Derivatives Fundamentals and Options Licensing Course (DFOL)

- LLQP Insurance Course (LLQP)

- Dealing with High Net Worth Clients program

Personal Financial Planner (PFP®)

What is Personal Financial Planner (PFP®)?

The Personal Financial Planner (PFP®) designation is a leading credential for comprehensive financial planning in Canada, recognized by Canada's largest financial institutions. It ensures that financial professionals have the knowledge and skills to address all aspects of a client's financial situation.

When you earn the PFP®, you will hold the premier designation recognized and adopted by Canada's largest financial institutions, and held to the highest standards through its accreditation.

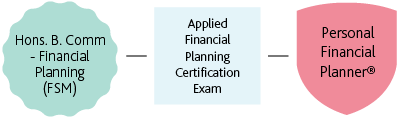

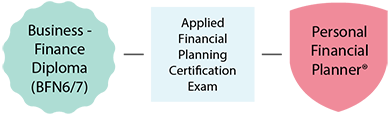

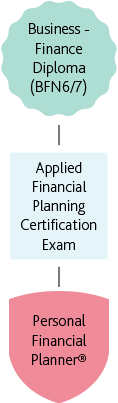

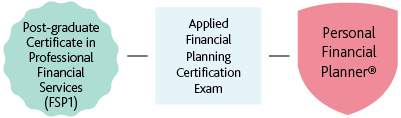

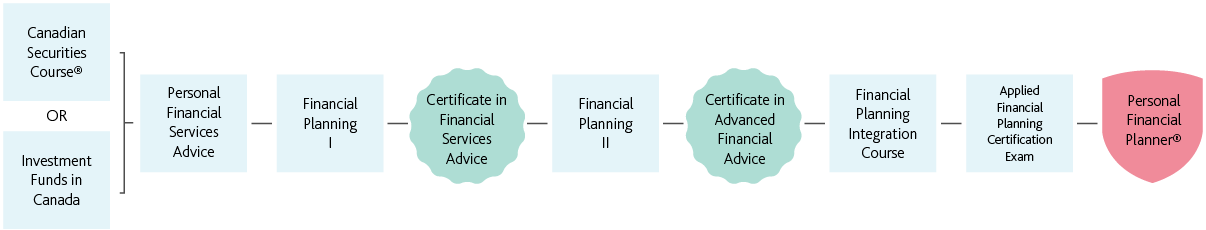

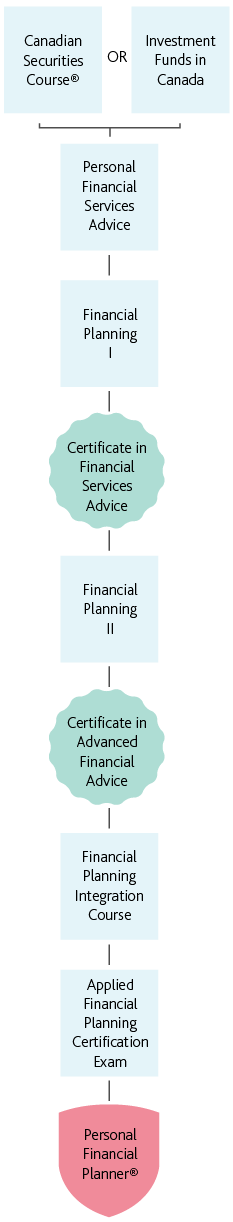

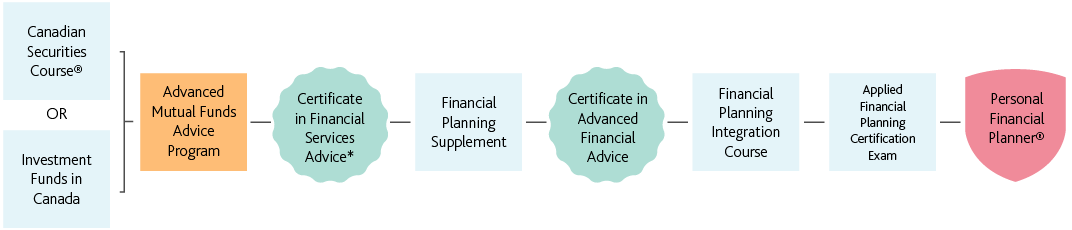

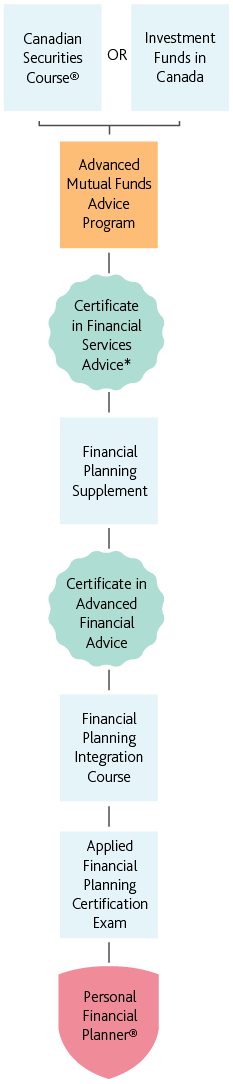

What is the path to the Personal Financial Planner (PFP®) designation?

CSI offers three paths to achieve the PFP® designation. We also offer various paths through our partner post-secondary institutions.

Pathway for Banking and Credit Union Employees

Pathway for Investment Advisors

Pathway for Independent Mutual Fund Advisors1

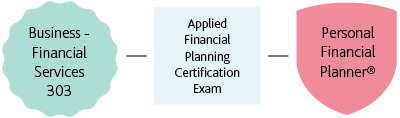

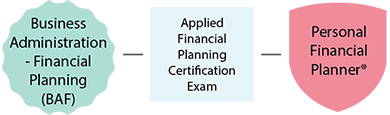

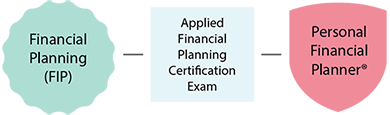

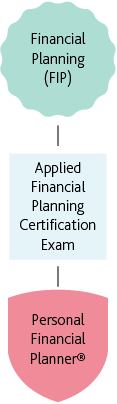

Mohawk College Route

Seneca College Routes

Fanshawe College Routes

5 Year Rule

It’s important to note that if the Financial Planning Integration Course (FPIC) was completed more than 5 years ago you will not be eligible to enroll into the Applied Financial Planning (AFP) Certification Examination. You will be required to retake the Financial Planning Integration Course (FPIC) to ensure your knowledge is current.

Advanced Standing Information for F.Pl. or CFP® Designation Holders

Individuals who hold the Certified Financial Planner (CFP®) or F.Pl. designation granted by the Insitut québécois de planification financière (IQPF) may apply directly to write the AFP Certification Examination. Candidates will be required to provide proof of the good standing of their qualifications and must meet all other PFP® designation requirements.

Course Exemptions

Individuals who have completed recognized financial planning courses from educational providers other than CSI can apply for course exemptions. Use the Exemption Request Form to apply for a course exemption.

Course providers that would like to have their programs assessed for approval as an educational route to the PFP® should contact CSI after reviewing the accreditation information.

Chartered Investment Manager (CIM®)

What is Chartered Investment Manager (CIM®)?

The Chartered Investment Manager (CIM®) designation is the industry standard for discretionary investment and portfolio management services. It is recognized by Canadian securities regulators and ensures that those who earn it are qualified to evaluate and manage all aspects of a client's investment portfolio. When you earn the CIM®, you become an investment advisor qualified to manage money on a discretionary basis for an increasing number of sophisticated clients.

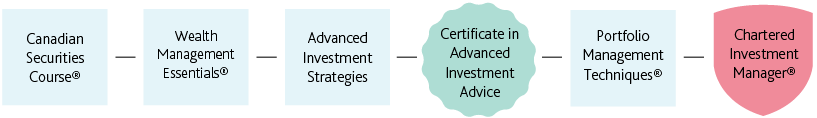

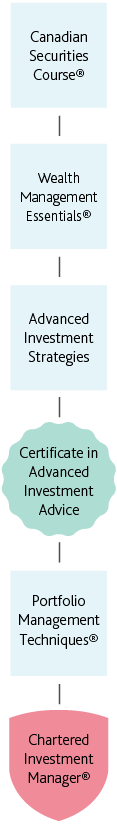

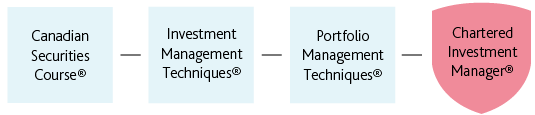

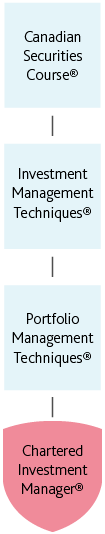

What is the path to the Chartered Investment Manager (CIM®) designation?

CSI offers two paths to achieve the CIM® designation.

Route 1

Route 2

5 Year Rule

Individuals must apply for the designation within five years of successfully completing the Portfolio Management Techniques (PMT®) Examination. Individuals who do not qualify for the designation within this 5-year period will be required to re-take the PMT® course and examination before being granted the designation.

Certified International Wealth Manager (CIWM)

What is the Certified International Wealth Manager (CIWM)?

The Certified International Wealth Manager (CIWM) designation is recognized worldwide as a top credential for wealth management. It ensures that financial professionals have the unique knowledge and skills to address the complex needs of high-net-worth clients.

Co-granted by the Canadian Securities Institute (CSI) and the Association of International Wealth Management (AIWM), the CIWM has international recognition and portability—creating career opportunities for you anywhere in the world.

Learn more about the changing wealth management industry by reading the Whitepaper 'Defining the Wealth Management Industry and Practice in Canada.'

What are the Pre-requisite Requirements?

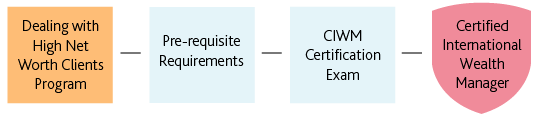

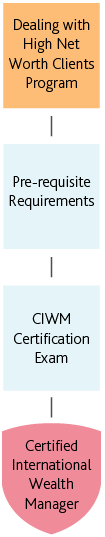

To be eligible for enrolment in the CIWM Certification Examination, candidates must meet the pre-requisite requirements and complete the Dealing with High Net Worth Clients Program.

The pre-requisite requirements for registration in the CIWM Certification Exam are:

- Candidates must hold either a Financial Planning (PFP®, CFP®, CLU or IQPF) or Investment Management (CIM®, CIM or CFA®) designation, or

- Have completed CSI’s Wealth Management Essentials (WME®) Course

What is the path to the Certified International Wealth Manager (CIWM) designation?

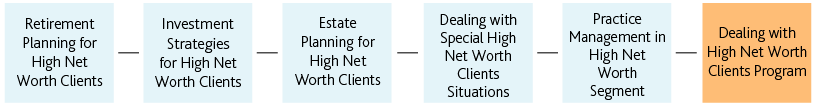

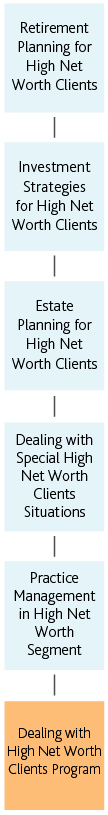

The Dealing with High Net Worth Clients (DHNW) Program consists of 5 online courses

What is Dealing with High Net Worth Clients (DHNW)?

Candidates must complete the Dealing with High Net Worth Clients Program before enrolling in the CIWM Certification Examination. The Dealing with High Net Worth Clients Program is the core education component on the path to the CIWM designation. It includes a wide variety of courses focused on the knowledge and skills required of an advisor dealing with high-net-worth clients. It offers a modularized structure that makes the curriculum bite-sized, accessible, and flexible for learners. It also provides recognition of a student’s prior learning.

The modular structure allows learners to select topics most relevant to their needs. In addition, learners will be able to incrementally earn multi-jurisdictional CE credits, micro-certificates (represented by digital badges), course completions, and certificates while working towards completing the internationally recognized CIWM designation.

Note: There are no pre-requisites to enroll in any of the courses within the Dealing with High Net Worth Clients Program. Enrolment is open to anyone.

Course Exemptions and Recognition of Prior Learning

As candidates for the CIWM have generally been in the industry for at least several years, they likely will already have taken parts of the curriculum through other course offerings. Please see the following table to identify courses that are considered equivalent to the courses within the Dealing with High Net Worth Clients Program.

| Course Exempted | CSI Course That Gives Exemption | CSI Certificate That Gives Exemption | External Certification That Gives Exemption* |

|---|---|---|---|

| Retirement Planning for High Net Worth Clients | Advanced Retirement and Estate Planning Strategies | Certificate in Retirement Strategy | |

| Advanced Retirement Management Strategies | |||

| Investment Strategies for High Net Worth Clients | Advanced Investment Strategies | Certificate in Advanced Investment Advice | Chartered Financial Analyst |

| Investment Management Techniques® | CIM or CIM® | ||

| Estate Planning for High Net Worth Clients | Advanced Retirement and Estate Planning Strategies | Certificate in Estate Planning and Trust Strategy | Chartered Life Underwriter |

| Advanced Estate Planning and Trust Strategies | Trust and Estate Practitioner |

External Designation Recognitions are subject to CSI’s External Designation Recognition policy and fee.

Individuals who have completed recognized wealth management courses from educational providers other than CSI can apply for course exemptions. Use the Exemption Request Form to apply for a course exemption.

CIWM Certification Examination Requirements

The CIWM Certification Examination will assess the candidate’s expertise in developing strategies and relationships with high-net-worth clients. The examination has three components based on a high net worth client scenario to be completed over the course of 8 weeks. The level of effort required is estimated at 25-35 hours.

Designated Financial Services Advisor (DFSA™)

What is the Designated Financial Services Advisor (DFSATM) designation?

The Designated Financial Services Advisor (DFSATM) designation is a leading credential for financial advice in Canada. Used by Canada's largest financial institutions, it ensures that financial advisors have the knowledge and skills to provide appropriate advice to address a client's financial situation.

What are the requirements to earn the Designated Financial Services Advisor (DFSATM) designation?

The requirements to earn the Designated Financial Services Advisor (DFSATM) designation are defined by the DFSA Competency Profile. This profile is aligned with industry best practices and provides the knowledge and skills applied by advisors. It also drives the pre-requisite requirements, education and ongoing maintenance requirements.

To be eligible to earn the DFSA designation, candidates must complete Investment Funds in Canada (IFC) and agree to:

- Complete one of the educational paths;

- Complete application form and attestation;

- Abide by the Code of Ethics, the Ethical Misconduct Process and the Trademark License Agreement; and

- Commit to ongoing continuing education once the designation education path has been completed.

Note: Completion of the Canadian Securities Course (CSC®) grants an exemption to the IFC.

If you have any questions regarding eligibility, please contact your employer directly.

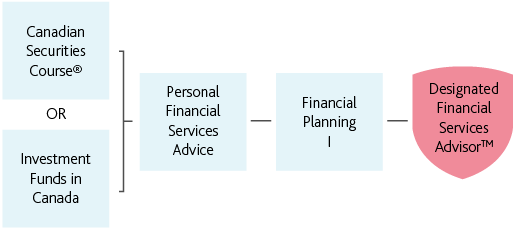

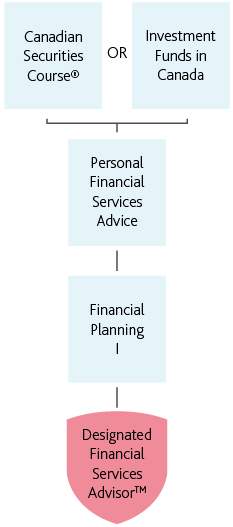

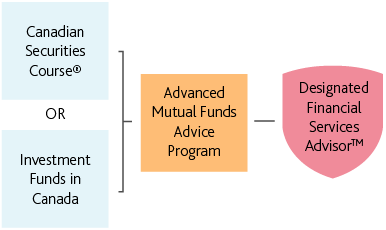

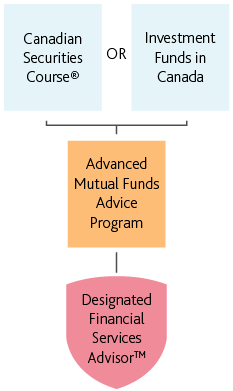

What is the path to the Designated Financial Services Advisor (DFSATM) designation?

CSI offers three educational paths to achieve the DFSATM designation. The DFSATM requires applicants to complete an approved education path within 2 years of being granted the designation.

Course Pathway for Banking and Credit Union Employees1

Course Pathway for Investment Advisors2

Mobile_DFSA – Pathway for Investment Advisors

Course Pathway for Independent Mutual Fund Advisors3

Estate & Trust Professional (MTI®)

What is MTI® Estate & Trust Professional (MTI®)?

The MTI® Estate & Trust Professional (MTI®) designation is Canada's premier designation for estate and trust management. It ensures that financial professionals have expertise in the regulations and tax implications that are characteristic of the management and transfer of wealth.

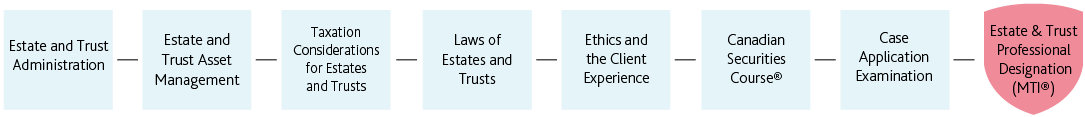

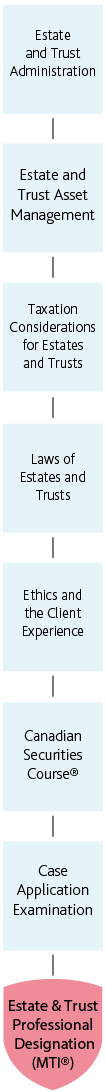

What is the path to the MTI® Estate & Trust Professional (MTI®) designation?

The learning path leading to the MTI® designation provides the skills and knowledge that reflect today’s industry best practices, helping client-focused professionals align their education with career goals. Each course is designed to build knowledge while progressing one’s career.

MTI® Pathway

5 Year Rule

The educational path must be completed not more than 5 years prior to application to write the Case Application Examination. Exemptions can be granted for courses offered by other education providers. If an individual has exceeded the 5-year timeline, completion of either the Estate and Trust Management or the Laws of Estates and Trusts course (or equivalent) will be required.

Individuals must apply for the designation within 5 years of successfully completing the Case Application Examination. Individuals who do not qualify for the designation within this 5-year period will be required to re-take the Case Application examination prior to being granted the designation. They will not be required to re-take the educational path.

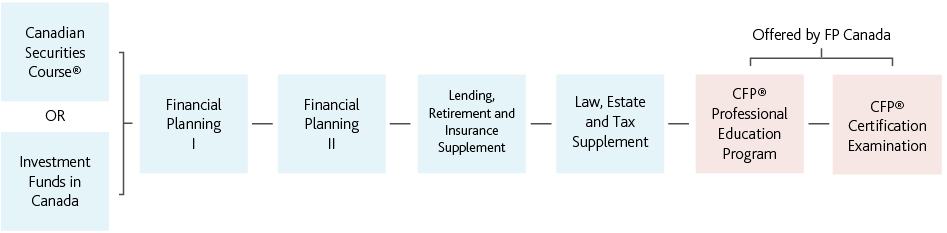

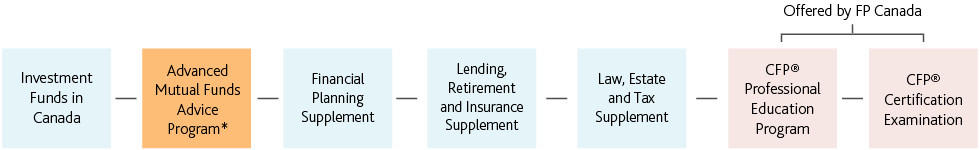

CSI Path to Certified Financial Planner (CFP®)

What is Certified Financial Planner (CFP®)?

CSI provides you with three streams towards achieving the CFP® certification. Each of these three streams meets the educational requirements of the FP Canada Approved Advanced Curriculum Program on the path to CFP® certification and is tailored to the intricacies of the industry (banking, mutual fund dealer or investment dealer) it is designed for. It is recommended that students opt for the route of the industry they work in or aspire to, as that route is best structured and nuanced for that particular field.

Please refer to the FP Canada website for more information on the CFP® certification.

What is the CSI path to the Certified Financial Planner (CFP®) certification?

CSI offers three paths to the CFP® certification.

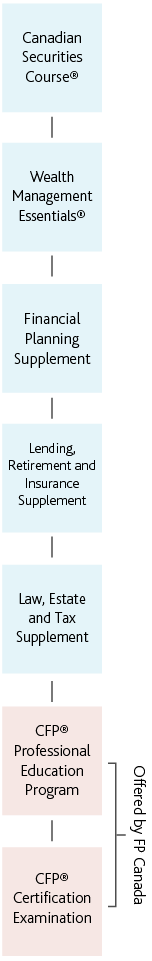

Stream 1: CFP® Certification Route for Bankers

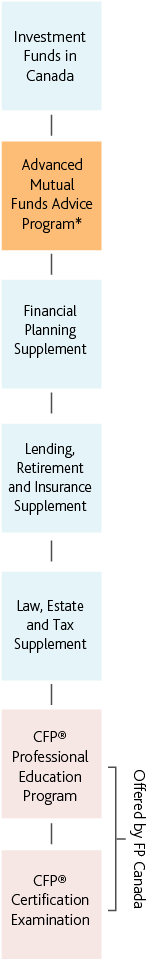

Stream 2: CFP® Certification Route for Mutual Fund Representatives (CIRO)

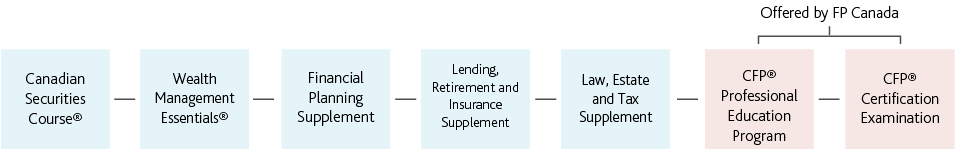

Stream 3: CFP® Certification Route for Investment Advisors (CIRO)

Pre-requisite Requirements

Please refer to the FP Canada website for information on experience requirements and pre-requisites (such as college/university diplomas or degrees).

CFP® Certification License and Trademark

The CFP® designation is not awarded by CSI. It is granted under license by the Financial Planning Standards Council to those who have met its educational standards, passed the CFP® Examination, satisfied a work experience requirement and agree to abide by FP Canada Code of Ethics.

CFP®, Certified Financial Planner® and CFP® (with flame logo) are trademarks owned outside the U.S. by Financial Planning Standards Board Ltd. Financial Planning Standards Council is the marks licensing authority for the CFP® marks in Canada, through agreement with FPSB.

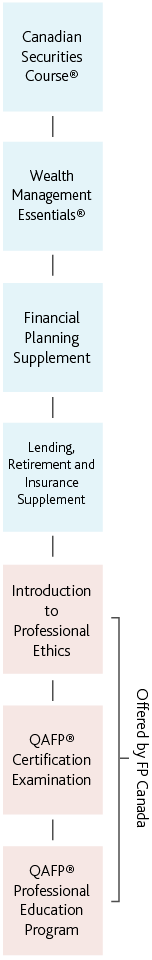

CSI Path to Qualified Associate Financial Planner (QAFP™)

What is Qualified Associate Financial Planner (QAFP®)?

CSI provides you with three streams towards achieving the QAFP® certification. Each of these streams meets the educational requirements of the FP Canada Approved Core Curriculum Program on the path to QAFP® certification and is tailored to the intricacies of the industry (banking, mutual fund dealer or investment dealer) it is designed for. It is recommended that students opt for the route of the industry they work in or aspire to, as that route is best structured and nuanced for that particular field.

Please refer to the FP Canada website for more information on the QAFP® certification.

What is the CSI path to the Qualified Associate Financial Planner (QAFP®) certification?

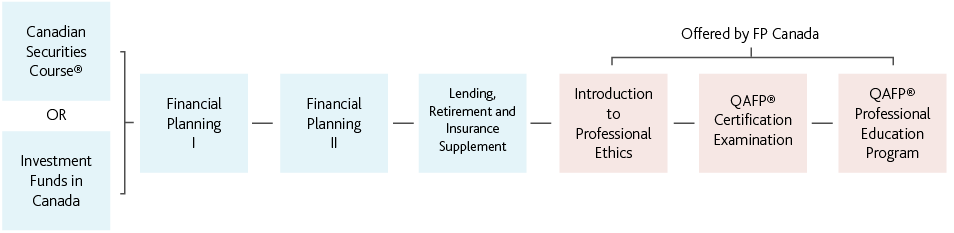

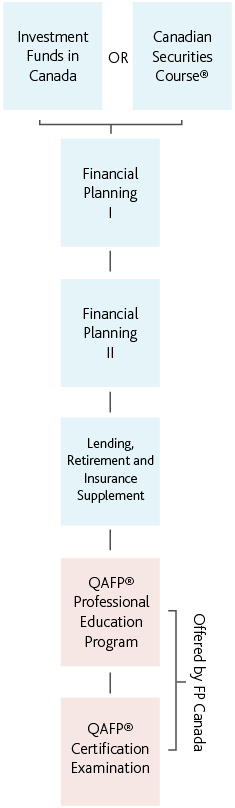

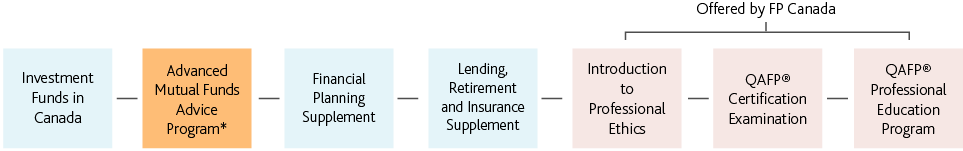

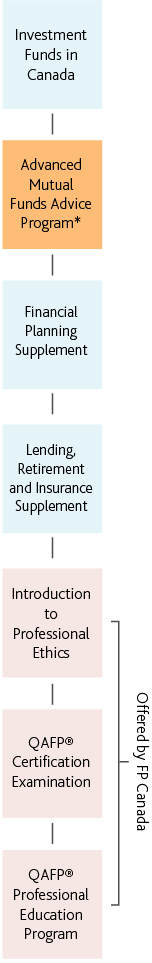

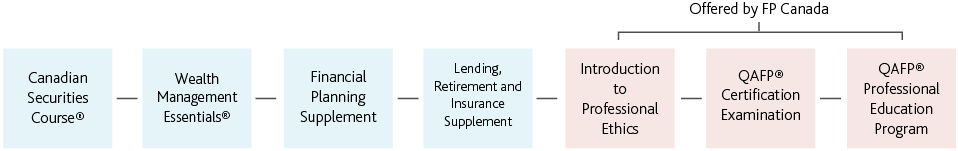

CSI offers three paths to the QAFP® certification.

Stream 1: QAFP® Certification Route for Bankers

Stream 2: QAFP® Certification Route for Mutual Fund Representatives (CIRO)

Stream 3: QAFP® Certification Route for Investment Advisors (CIRO)

Pre-requisite Requirements

Please refer to the FP Canada website for information on experience requirements and pre-requisites (such as college/university diplomas or degrees).

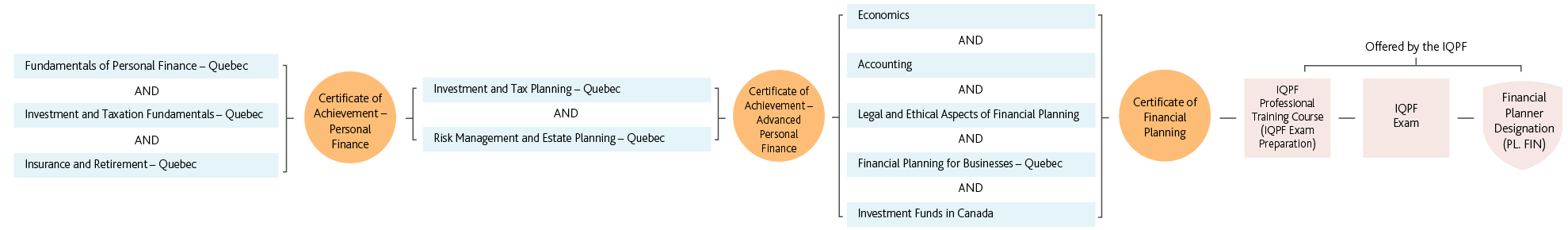

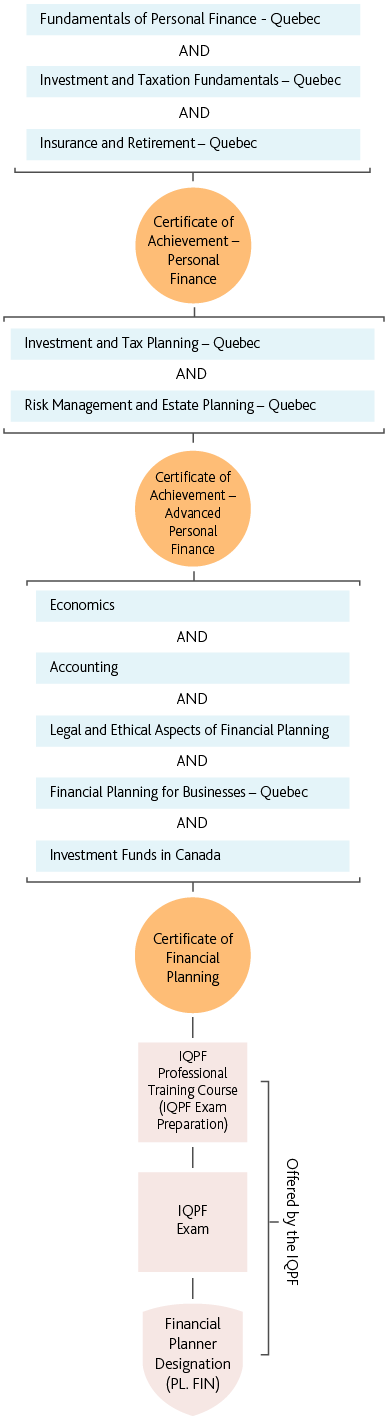

CSI Path to Financial Planning Program – Quebec (IQPF)

What is the CSI Financial Planning Program – Quebec?

Earn the Financial Planner (Pl. Fin.) designation and offer your clients the assurance of proven competency when you help them meet their financial goals. CSI’s financial planning education pathway meets Quebec's provincial requirements and leads to the IPF Financial Planning Exam.

The Institut de planification financière (IPF) is the only organization in Quebec authorized to grant financial planning diplomas and to establish rules concerning the ongoing professional development of professional financial planners. Please refer to the IPF website for more information.

What is the CSI path to the IPF designation?

Important Note

Students interested in the IPF Professional Training Course and the IPF Exam Preparation must register with the IPF directly and include a copy of their Undergraduate certificate(s) and CSI Student Transcript.

Pre-requisite Requirements

Please refer to the IPF website for information on experience requirements and pre-requisites (such as college/university diplomas or degrees).